Fast Process

Apply effortlessly with just one required document

Apply effortlessly with just one required document

Your data is protected, and we provide solutions precisely when you need them

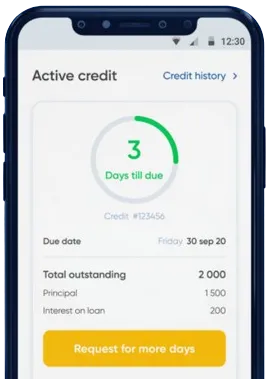

Experience hassle-free money transfers and flexible loan terms

Easily initiate your loan request by filling out a simple form within our user-friendly app.

You’ll receive our decision in approximately 15-30 minutes, keeping you informed every step of the way.

Enjoy the convenience of quick transactions, getting you the financial support you need without delay.

Use the app to send your request, simply fill in the form.

Download loan app

Unexpected financial emergencies can occur at any time, leaving individuals in urgent need of funds to cover essential expenses. In Nigeria, securing an urgent 2k loan can offer a swift and effective solution to these pressing financial challenges. Whether you're facing unforeseen medical bills, urgent home repairs, or need to stabilize your financial situation, these loans provide a range of benefits tailored to meet your immediate needs. Additionally, having access to quick funds can prevent minor issues from escalating into major financial burdens.

An urgent loan in Nigeria is specifically designed to assist individuals who require immediate financial assistance. Unlike traditional loans that often involve lengthy approval processes and extensive documentation, urgent loans offer a streamlined approach to obtaining the necessary funds quickly. This makes them an ideal choice for those who find themselves saying, "I need a loan urgently in Nigeria," and require a fast and reliable financial solution. These loans cater to a variety of urgent needs, ensuring that borrowers can address their financial challenges without unnecessary delays.

One of the most significant advantages of urgent 2k loans in Nigeria is their rapid approval process. When time is of the essence, these loans ensure that borrowers can access funds swiftly, often within minutes of application. This expedited process is particularly beneficial in emergency situations where delays can exacerbate financial stress. Furthermore, the simplified application procedures reduce the overall time spent on securing a loan, allowing borrowers to focus on resolving their urgent financial issues promptly.

Unlike traditional loans that typically require collateral, an urgent loan in Nigeria without documentation is usually unsecured. This means that borrowers do not need to provide any assets as security to qualify for the loan. The absence of collateral requirements makes these loans accessible to a broader range of individuals, including those who may not have significant assets to pledge. This inclusivity ensures that more people can benefit from immediate financial support without the risk of losing valuable possessions.

The lack of collateral not only simplifies the application process but also speeds up the approval timeline. Since lenders do not need to assess the value of any assets, the focus is solely on the borrower's ability to repay the loan based on their current financial situation. This approach reduces the overall complexity of securing a loan, making it easier for individuals to obtain the funds they need quickly and efficiently.

An urgent 2k loan can be a lifeline for individuals facing immediate financial challenges. Whether you're dealing with unexpected medical expenses, urgent home repairs, or the need to consolidate debt, this type of loan provides the necessary funds quickly. For those who find themselves thinking, "I need urgent money," an urgent 2k loan offers a reliable and efficient financial solution. Additionally, these loans can help maintain your credit score by ensuring timely payments, even in the face of unexpected financial setbacks.

Flexibility in repayment is a crucial factor for borrowers, especially when dealing with urgent financial needs. Urgent loans for bad credit in Nigeria come with various repayment options that cater to the diverse financial circumstances of borrowers. This flexibility ensures that repayment plans are manageable and tailored to individual cash flows. By offering multiple repayment schedules, lenders help borrowers avoid defaulting on loans, thereby maintaining their financial stability and creditworthiness.

One of the standout features of urgent loans is the ability to receive funds within minutes. With advancements in financial technology, obtaining a loan in minutes in Nigeria has become a reality. This rapid disbursement of funds provides immediate relief during financial emergencies, ensuring that borrowers can address their urgent needs without unnecessary delays. Additionally, the seamless integration of online platforms allows for a smoother and more efficient borrowing experience, enhancing overall customer satisfaction.

Applying for an urgent 2k loan in Nigeria is a straightforward and convenient process that can be completed online from the comfort of your home or office. This eliminates the need for in-person visits to lenders, saving both time and effort. The online application process is designed to be user-friendly, allowing borrowers to submit their applications quickly and efficiently. Furthermore, the ability to apply from anywhere provides greater accessibility, enabling individuals to secure funds regardless of their location.

Moreover, online applications are typically processed faster than traditional loan applications. This means that borrowers can receive approval and access to funds without delay, making it easier to address urgent financial needs promptly. The digital nature of the application process also ensures that all information is securely handled, providing peace of mind to borrowers concerned about data privacy and security.

Urgent 2k loans in Nigeria offer a range of benefits that make them an invaluable financial resource for individuals in need of immediate funds. From a quick approval process and flexible repayment options to the absence of collateral requirements, these loans provide a convenient and accessible solution for managing financial emergencies. Whether you're saying, "I need a loan urgently in Nigeria" or "I need urgent money," these loan options ensure that financial support is readily available when you need it the most. By choosing an urgent 2k loan, you can navigate unexpected financial challenges with greater ease and confidence, securing the funds you need to maintain your financial stability. Additionally, the streamlined application process and rapid fund disbursement mean that you can focus on resolving your financial issues without added stress or delay.

Yes, you can apply for an urgent 2k loan in Nigeria through various online lending platforms or financial institutions that offer such services.

The typical requirements for obtaining an urgent 2k loan in Nigeria may include proof of identity, proof of income, a valid bank account, and sometimes collateral depending on the lender.

The time it takes to receive the funds from an urgent 2k loan can vary depending on the lender, but in some cases, you can receive the funds within 24 hours of approval.

The usual repayment period for an urgent 2k loan in Nigeria can range from a few weeks to a few months, depending on the terms and conditions set by the lender.

Some lenders in Nigeria may still consider your application for an urgent 2k loan even if you have a bad credit score, but you may be charged a higher interest rate or asked to provide additional collateral.

If you are unable to repay the urgent 2k loan on time, you may incur late fees or additional charges, and it could also negatively impact your credit score. It's best to communicate with the lender as soon as possible if you foresee any issues with repayment.