Financially Sound

Instant, easy solutions from anywhere. Apply with just one required document

Instant, easy solutions from anywhere. Apply with just one required document

Rely on our direct lending for security and innovation. Your data is protected, and we offer solutions when you need them

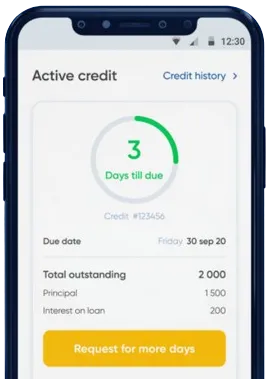

A simple, rapid solution from the comfort of your home. Instant money transfers and flexible loan periods

Use the app to send your request, simply fill in the form.

Wait briefly for our decision, typically 15 minutes.

Get the funds. Transactions are generally completed in one minute.

Use the app to send your request, simply fill in the form.

Download loan app

Financial emergencies can arise unexpectedly, leaving many individuals in urgent need of funds to cover expenses. In Nigeria, obtaining an urgent 2k loan can provide a quick solution to such predicaments. These loans offer a range of benefits that can be advantageous to borrowers in various ways.

Urgent 2k loans in Nigeria typically have a fast approval process, allowing borrowers to access funds quickly when they need them the most. This can be particularly beneficial in emergency situations where time is of the essence.

Unlike traditional loans that often require collateral, urgent 2k loans in Nigeria are typically unsecured. This means that borrowers do not need to provide any assets as security to qualify for the loan, making it accessible to a wider range of individuals.

Additionally, the absence of collateral speeds up the approval process, as lenders do not need to assess the value of the assets provided.

Urgent 2k loans in Nigeria come with flexible repayment options that cater to the needs of borrowers. Lenders offer various repayment terms, allowing individuals to choose a plan that suits their financial circumstances.

Applying for an urgent 2k loan in Nigeria is a convenient process that can be completed online from the comfort of one's home or office. This eliminates the need for in-person visits to the lender's office, saving time and effort for borrowers.

Moreover, online applications are typically processed faster, allowing borrowers to receive approval and funds without delay.

In conclusion, urgent 2k loans in Nigeria offer a range of benefits that make them a valuable financial resource for individuals in need of immediate funds. From quick approval processes to flexible repayment options, these loans provide a convenient and accessible solution for managing financial emergencies.

Yes, you can apply for an urgent 2k loan in Nigeria through various online lending platforms or financial institutions that offer such services.

The typical requirements for obtaining an urgent 2k loan in Nigeria may include proof of identity, proof of income, a valid bank account, and sometimes collateral depending on the lender.

The time it takes to receive the funds from an urgent 2k loan can vary depending on the lender, but in some cases, you can receive the funds within 24 hours of approval.

The usual repayment period for an urgent 2k loan in Nigeria can range from a few weeks to a few months, depending on the terms and conditions set by the lender.

Some lenders in Nigeria may still consider your application for an urgent 2k loan even if you have a bad credit score, but you may be charged a higher interest rate or asked to provide additional collateral.

If you are unable to repay the urgent 2k loan on time, you may incur late fees or additional charges, and it could also negatively impact your credit score. It's best to communicate with the lender as soon as possible if you foresee any issues with repayment.